Forex Trend Trading Strategies

Trading with the trend is one of the safest ways of engaging the capital markets and a great strategy for maximizing profits. FX Leaders’ top analysts use trend trading strategies as one of their primary approaches to the markets. In addition, before making a trade or issuing a signal, they always confirm which side of the trend they are on.

What Are Trends?

Trends come in many different shapes and sizes. Some are channels with parallel upper and lower trendlines, while others have only a single trendline. This is an important distinction as a trend with only one trendline will have a line acting as support in an uptrend and a line acting as resistance in a downtrend.

We should keep in mind that due to the human nature of the market, trends don’t always follow a perfectly symmetrical trend line. When trading, we should be flexible and react to the actions of the market.

Novice traders tend to think that trend trading is easy. Simply find the trend and get in alongside prevailing price action. In practice, it’s not that easy. As with all other aspects of this game, many dilemmas pop up when trying to identify the trend. Here are a few questions that regularly come up when attempting to get in on a trend:

- Is this a new trend or just a retrace?

- Am I too late to get in on the trend?

- Is the risk/reward ratio worth taking?

These are some of the questions we ask ourselves when trying to identify and use trend trading strategies. By doing a thorough analysis, we can overcome these dilemmas and get a better view of the bigger picture of what is going on and what is to come.

Is This A New Trend Or Just A Retrace?

To see if what is forming is a new trend, or merely a retracement an existing trend, we have to wait for the trend to set up properly and break specific levels. If we don’t, we might be jumping in at the end of a retrace and get burned by a price reversal.

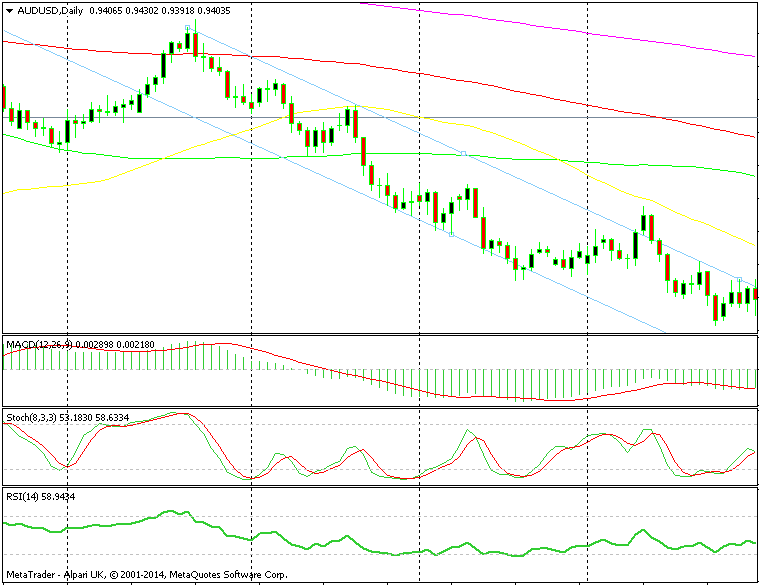

On the GBP/USD weekly chart below, we can see the price being rejected at the previous lows. However, we can’t place a long trade as we are unsure whether a real trend is forming. The confirmation of a new valid trend comes after the break and close of the long black line which is a previous long-term support.

Am I Too Late To Get In On The Trend?

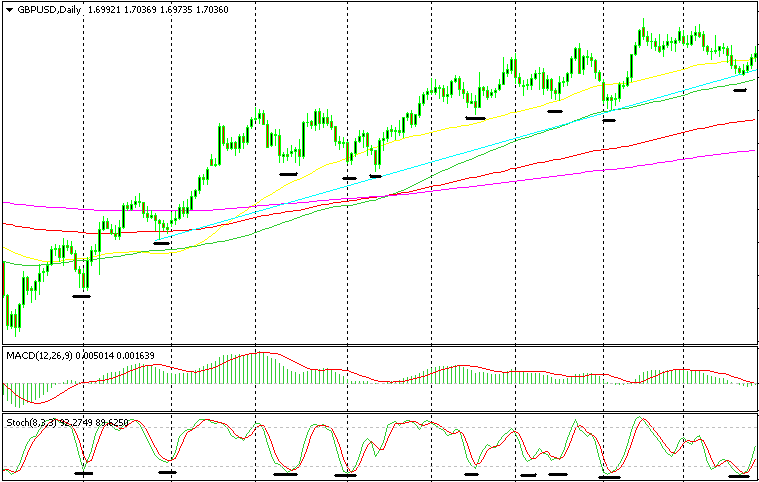

The most daring traders aim to catch trends early. To do so, they have to anticipate price action before it becomes defined. We can see on the GBP/USD monthly chart below that the pair has been trading in a tight range after a downtrend. There are two monthly pin candles that show that there is strong buying pressure around 1.48-49 level. In addition, there is divergence on all three indicators, MACD, Stochastics, and RSI. These elements all serve as confirmation that a new trend is forming.

Don’t know what pin candles are? Click Here to learn

Is The Risk/Reward Ratio Worth Taking?

To get a better risk/reward payoff in trend trading strategies we must first see the potential of the direction we want to enter. In the monthly chart below we see that the pair used to trade around 2.1, 5 years ago and after a big fall, it traded in the 1.60 – 1.70 range for most of a 5 year period. This gives us a 2000 pip potential target and around 350 pip potential loss making the risk/reward ratio about 1 to 6.

The price is being rejected at the previous lows, but we can’t place a long yet as we are unsure whether a real trend is forming

Two pins indicate strong buying pressure which means an uptrend is about to begin

Trend Trading Strategies: Choosing The Best One For The Job

Identifying the trend isn’t all that has to be done. After we have identified the trend, we must decide which trend trading strategies to follow.

There are 3 major trend trading strategies:

- Enter and Let Run – This strategy is for the most conservative traders who don’t like to risk much or take risks very often. As the name indicates, it consists of placing a trade after identifying the trend and letting it run its course. These kinds of trades, being conservative trades, are usually placed after the trend is confirmed, typically after the support line on the daily chart is broken.

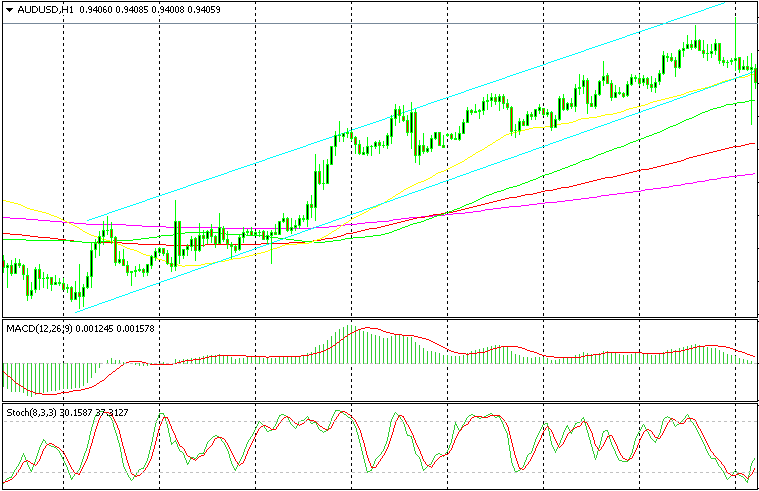

- In and Out – This strategy is for the risk-moderate traders who like to raise the risk a bit in exchange for more profit. ‘In and Out’ strategy consists of placing trades based on the main trend but with smaller time frame chart analysis. Traders who choose to use this strategy take positions during the retraces on the smaller time frame charts when indicators show the pair is oversold and unload them when the same chart shows it has reached overbought levels, indicating another retrace is due. The daily chart below shows the levels to get in. Learn more about using multiple time frames

- Adding Up – This strategy is for traders who want to take full advantage of the trend and milk every pip out of it. Enter a trade after identifying a trend, long in this case, and keep adding to that position on every retrace on the shorter timeframe charts. This is an extremely profitable strategy but you should be very cautious the higher it goes. Due to the number of positions on the higher end, your profit can erode very quickly on a reversal and you might even end up with a loss.

Oversold areas indicate opportunities for longs

AUD/USD is trading in an uptrend channel. Which trend trading strategies are best for the job?

Getting Started With Trends

Trends are an integral part of the financial markets. Whether one is trading forex, futures, or equities, selecting an ideal trend trading strategy can be a profitable exercise. For more information on trends as they unfold in real-time, stay tuned to the Live News Feed at FX Leaders. If there is a market on the move, the analysts there will offer insights, signals, and ideas on how to get in on the action.